Debunking Common Myths About Litigation Funding: What Attorneys Need to Know

While traditional litigation loans have long been available to plaintiffs, pre-settlement funding has emerged as a distinct and increasingly important financial resource for those facing extended litigation periods. Unlike loans that create debt obligations, pre-settlement funding provides financial support without the burden of monthly payments or credit requirements. As demand for litigation funding continues to grow, many attorneys and clients still have questions about how it works and its impact on cases.

At USClaims, we believe in data-driven insights. In 2024, we surveyed over 150 USClaims funding recipients about their experiences with pre-settlement funding, revealing compelling insights that challenge common misconceptions and demonstrate the practical benefits of these services.

The Data Speaks: Client Satisfaction and Outcomes

Our recent survey of funding recipients revealed:

- 90% of recipients would recommend litigation funding to others in similar situations.

- 87% rated their experience a 5 out of 5 in overall satisfaction.

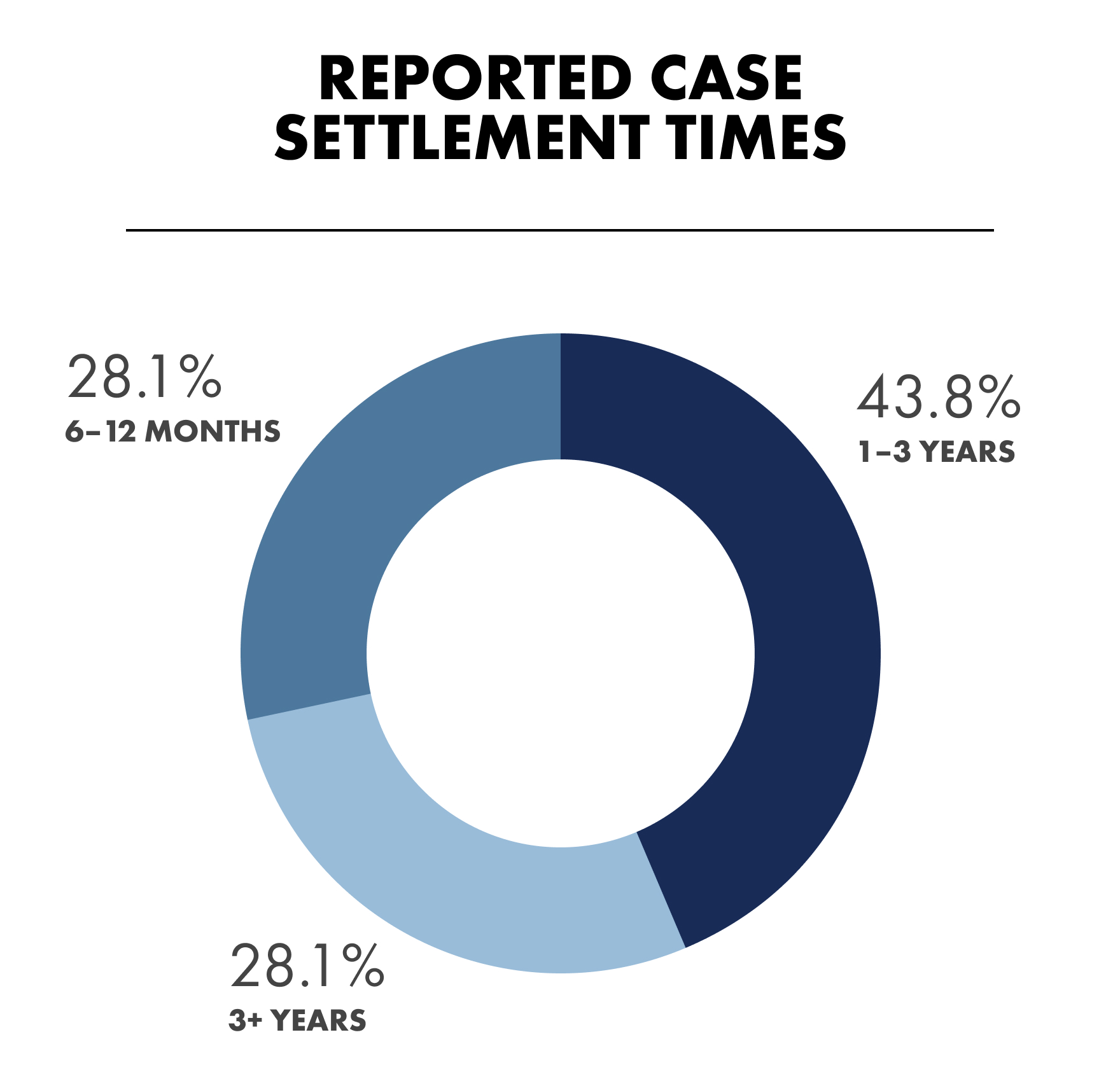

- 43.8% of respondents’ cases took between 1-3 years to resolve.

Myth #1: Pre-settlement Funding Creates Excessive Financial Burden for Clients

Reality: At USClaims, we’ve pioneered an ethical approach through our 2X CAP program. Unlike traditional funding providers that use compound interest with no limits, our simple interest rate of 36% annually is typically capped at 2X the funded amount. This means that your clients will never pay more than double their advance in eligible cases, regardless of how long their case takes to resolve.*

As a result of our ethical approach and our pricing cap, 87% of our clients gave us a rating of 5 out of 5 in overall satisfaction in using litigation funding with USClaims. This type of response directly suggests the critical importance of having access to responsible funding options that protect client’s long-term interests.

Myth #2: Funding Companies Interfere with Case Management

Reality: USClaims maintains strict boundaries to ensure we never interfere with the attorney-client relationship. Unlike commercial litigation funding where a funder typically funds the cost of litigation our funding is used by the client for personal related expenses. In personal injury law the handling attorney does get paid upfront and instead works on contingency basis. Therefore our role in consumer litigation funding is purely hands-off approach, and we have established clear protocols:

- We do not get involved in the decision making of the litigation process

- We do not contact clients to solicit them for funding or discuss case details

- We never offer opinions regarding legal strategy

- We only provide funding with the attorney’s explicit approval

- All communications about case specifics go through the representing attorney and their office

Myth #3: The Application Process is Complex and Time-Consuming

Reality: We’ve streamlined our process to be efficient and straightforward. Our funding experts work directly with law firms to minimize administrative burden, and most applications can be processed within 24 business-day hours of approval. Our focus is on making the process as seamless as possible so you can concentrate on your client’s legal needs. This efficiency allows your clients to access needed funds quickly while keeping your firm’s involvement minimal.

Clients need for funding is typically driven by the client’s individual financial needs as well as the status of their case. Our survey shows that most clients began using funding in the first year after retaining an attorney. More specifically, 44% of respondents began using a funding in the first 30 days; 32% began using funding in the first year and the rest of the resondents waiting more than a year to secure funding. This survey clearly illustrates that client needs are client specific and we have built our business to support them throughout the life of the case.

Myth #4: Pre-settlement Funding Evaluations Are Arbitrary

Reality: USClaims has a dedicated underwriting team whose mission is to review each and every funding request and come to our own conclusion regarding the merits of the case as opposed to relying on attorney’s representations. By USClaims evaluating each funding request, we remove the burden on the attorney to determine a potential case valuation, possibly placing the attorney in a quandary when the case resolves. This is important as we make our own decisions using a structured evaluation process that considers multiple factors including but not limited to:

- Case merit and strength of evidence

- Stage of litigation

- Estimated timeline to resolution

- Anticipated settlement value

- Insurance coverage

- Jurisdiction factors

Our survey data shows that case resolution varies widely with 25% of respondents indicating that it took more than 3 years for them to resolve their case.

Myth #5: Clients Don’t Understand the Terms

Reality: Transparency is fundamental to our process. We provide clear, straightforward agreements that explicitly outline:

- The simple interest rate structure*

- Our 2X CAP guarantee*

- The non-recourse nature of the funding

- All fees and terms in plain language

The high satisfaction rates from our survey (91% giving us 4 and 5 out of 5) reflect our commitment to clear communication and transparent terms. This transparency helps build trust with your clients and allows you to confidently recommend our services when clients face financial challenges. In addition to this, 90% would recommend litigation funding to others.

Myth #6: Pre-settlement Funding is Too Expensive Compared to Other Options

Reality: Our funding often provides significant advantages over traditional financing options:

-

- No monthly payments required

- No credit checks performed

- Lower effective rates than many credit cards

- Non-recourse funding means no repayment if the case is unsuccessful

- The 2X CAP provides cost certainty*

- Funding can help clients achieve better settlements by reducing financial pressure to settle early

Benefits for Your Practice

Pre-settlement funding can strengthen your practice by:

- Supporting Client Stability: Financially stable clients can focus on their recovery and case development rather than immediate financial pressures.

- Reducing Administrative Burden: Our dedicated case managers handle funding-related inquiries, allowing your staff to focus on legal work.

- Enhancing Client Satisfaction: With over 90% of clients willing to recommend litigation funding to others, this service can provide incremental value to your client’s legal journey.

Supporting Your Clients’ Success

Pre-settlement funding can be a valuable tool for supporting your clients through the litigation process. Our survey data reveals that partnering with a reputable provider like USClaims can offer your clients financial stability and maximize case outcomes without compromising the integrity of your practice.

Ready to Learn More?

Contact USClaims to discover how we can support your practice and clients:

- Call: (877) 757-0756

- Email: info@usclaims.com

- Visit: www.usclaims.com

Disclaimer: This article is for informational purposes only and should not be considered legal advice. Survey data is based on responses collected by USClaims from 159 funding recipients in 2024. All rates mentioned are simple interest rates, not compound rates.

*Available funding options, including our 2X CAP program, may vary by jurisdiction and case type. Please contact USClaims for specific details regarding your claim.